Judith Shadzi, VP, Cosmic Solar, 2022

As early as 1839, a scientific discovery was made revealing solar energy. Edmund Becquerel, the 17-year-old son of a French scientist, took an electrolytic cell into the yard of his father’s Paris laboratory. He noticed the sun activated the cell’s activity and recorded the discovery of the “Photovoltaic Effect”. 1905, seventy years later in Switzerland, Albert Einstein wrote four groundbreaking papers about the law of the photelectric effect upon which countless inventions resulted from, including the PV solar panel.

The first prototype solar panel was built by Bell Laboratories in 1954. The New York Times reported in 1954, “The Bell invention marked the beginning of a new era…harnessing the sun’s almost limitless energy for the uses of civilization.”

Solar energy in the form of solar panels for homes did not become available to the general public until about twenty years ago. When we founded Cosmic Solar, Inc in 2009, our main job was to educate people as to what solar was, and how it could benefit them. Today everyone wants solar because in most cases the payment on a loan is less than their electric bill.

According to Vector Engineering, there are 70,000,000 residential and commercial structures suitable for solar PV in the United States. The 2009 Bush Federal Tax Credit gave the solar industry a timely stimulus. California started out with a tax rebate designed by the Solar Energy Industries Association (SEIA), and signed by Governor Schwarzenegger, that boosted solar sales. In 2021, solar and wind generated 10% of power for 50 countries.

The utilities were cooperative in the beginning, but they had a 2 ½% limit for home and business owned solar, and then raised it to 5%. It appears that they never expected the solar industry to be this successful because they keep trying to raise service fees and lower the value of solar credits. We can see the struggle solar energy has had to become mainstream because we just have to follow the money. When home and business owners have their own solar, they make money. Saving money is making money.

There are people that have say, “SDGE seems to like solar, and have a whole department that supports solar energy.” The utilities are supportive of solar but they want to make all the profit themselves. If they build vast solar farms on hills and deserts and then transport the electricity just like they did from nuclear plants, etc. they can charge the customers, and make large profits just like they did before.

So those 70,000,000 rooftops just stay empty and instead they will cover our landscapes with solar farms. That is not only disruptive to our environment, but not aesthetically pleasing. There are a few good proposals such as water canals, landfills, and parking lots. It would prevent evaporation in water canals, and cover garbage landfills that no one wants to live on, and shade cars in parking lots, but to disrupt ecosystems is unnecessary when we have all the buildings that are already there.

The utilities have gotten creative in Sacramento and are giving builders the choice to have new homes partnership with the electric company. This means the utilities will bring electricity from solar farms for $60 a month, but don’t guarantee the amount of solar the homeowner will receive. The utilities are in control, and in small print it says you will never be able to have net metering for any additional panels.

In June of 2021, The Columbus Dispatch reported Ohio regulators approved three solar projects, two of them on 827 acres and 919 acres collectively in Preble County, near the Indian state line. A wind project was denied because of environmental concerns.

San Diego has the highest electric bills in the nation and CBS8 reports that despite strong opposition, the electric companies are now proposing a behind the meter solar consumption tax of $600 per year for the average customer. This will also affect commercial solar owners. With SDGE, the less electricity a homeowner uses the higher the tax. They also want to slash customer’s solar credits.

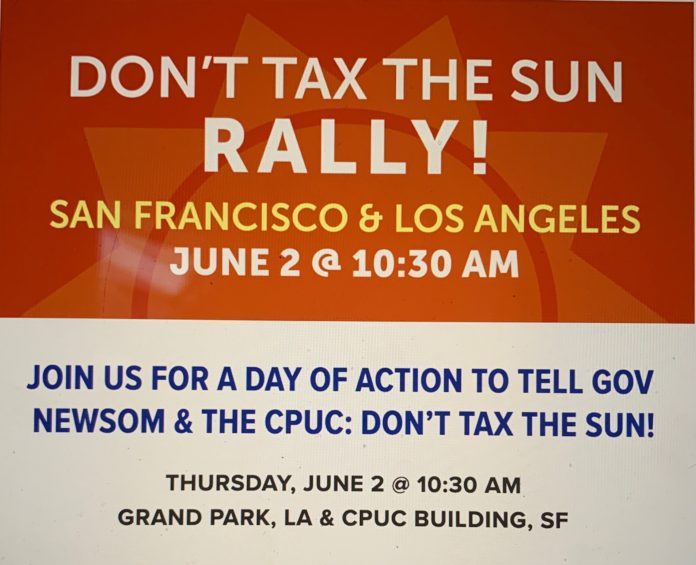

On May 9th the California Public Utilities Commission (CPUC) issued a NEM 3 decision. They are inviting feedback, so SEIA wants to give Governor Newsom a message loud and clear, NO SOLAR TAX. NO SOLAR CLIFF. There are two giant-in-person rallies and public testimony events in Los Angeles and San Francisco on June 2nd. The solar industry and solar home and business owners need to push back hard. SEIA is asking everyone that can to attend to make our voices heard.

If their new NEM 3 proposal passes it will cause solar companies to shut down their businesses or lay off half their staff in 2023 because the CPUC got NEM 3 horribly wrong. Solar will not be as affordable, and it will affect people’s ability to purchase solar systems. The most effective way to get media attention is to have a sea of people at these two rallies and stop the steal from the utilities.

For those who can’t attend, send petitions, letters, and emails to Governor Newsom’s office. We need to save our people’s solar industry in California.