∙

Steve Puterski

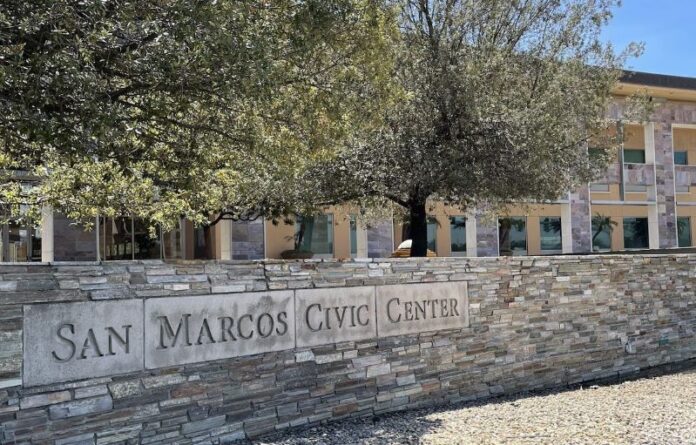

SAN MARCOS — Two local sales tax measures are heading to the ballot.

The city councils of Escondido and San Marcos each approved sending their respective one-cent general sales tax measures to the November election. However, Escondido engaged in some political gymnastics to ensure the measure qualified.

According to Escondido City Clerk Zack Beck, the measure was first brought forward by a citizens group, but the San Diego County Registrar of Voters could not certify all the signatures until Oct. 8, which is two months after the Aug. 9 deadline to qualify a ballot measure. So, the City Council took up the item during its July 10 meeting and passed it unanimously.

On July 9, the San Marcos City Council also unanimously approved its one-cent sales tax measure.

Both cities are facing structural budget deficits as Escondido is projecting a $10 million annual deficit each year for the next five years and $18 million over the next 20 years. San Marcos, meanwhile, balanced its budget with deep cuts but faced a $3.8 million deficit in Fiscal Year 2023-24.

Should the measures pass, all new sales tax revenue of the one cent increase will be allocated to each city instead of carving up funds, as with other sources, even the current sales taxes, leaders said. Escondido is projecting up to $28.3 million annually, while San Marcos staff estimate $20 million per year.